The FATCA Declaration: Fatca Details in NPS – NPS subscribers can FATCA Self-Certification Online. Fatca declaration form Download 2024 at https://cra-nsdl.com/CRA/

Fatca Details in NPS

Foreign Account Tax Compliance Act (FATCA), is a legal tax law that the U.S. introduced. The primary aim was to curb and follow up on tax evasion between countries with the Unites States taxpayer’s income from other countries. The FATCA has helped in accountability and transparency, thus directing all taxes in the proper channels. The US taxpayers need to be FACTA compliant; they must self-certify in every country they invest in using the FATCA form.

The process means if an Indian citizen or NRI lives in the USA but invests their money in India. They need to self-certify themselves through the FATCA form. However, the government has the right to suspend the taxpayer’s bank accounts and investments if the person doesn’t self-certify the investments.

What is FATCA

Importance of FATCA

The FACTA tax law was fully endorsed in 2010 to merge with the Hiring Incentive to Restore Employment (HIRE) Act. The law helps foreign financial and non-financial bodies to trace all US taxpayers’ details. The institutions report the information to the Internal Revenue Service (IRS). This enables the IRS to trace taxpayers evading taxes. The law is established to curb tax evasion and keep proper income records earned in other foreign countries.

The Indian government signed the agreement with the US in 2015. All Indian NRI living and working in the US but invests in India have to use the self-declaration FATCA form. The process is accessible through Form 16B of the income tax Act 1962. The US government checks the declaration for authentication. The FATCA works for NRI and PIOs living in the US.

Investments to Declare under FATCA

- National pension system

- Fix deposits

- Mutual funds

- Stocks

- Capital gains

- Bank interest

Assets that don’t apply under FATCA

- Houses property

- Antiques

- Cars

- Jewelry

- Souvenirs

Note taxpayers who don’t fill the FATCA declaration form can risk bank account suspension and all their investments. The FATCA requires every eligible taxpayer to comply with the law to suspension.

Importance of Self-Certification

The process applies to BRI taxpayers living in the US. The Indian Financial institution should request the taxpayer to certify their details.The institution will verify the information and approve the process. Evading the process leads to bank account and investments freezing by the government.

How to Make NPS Account FATCA Complaint

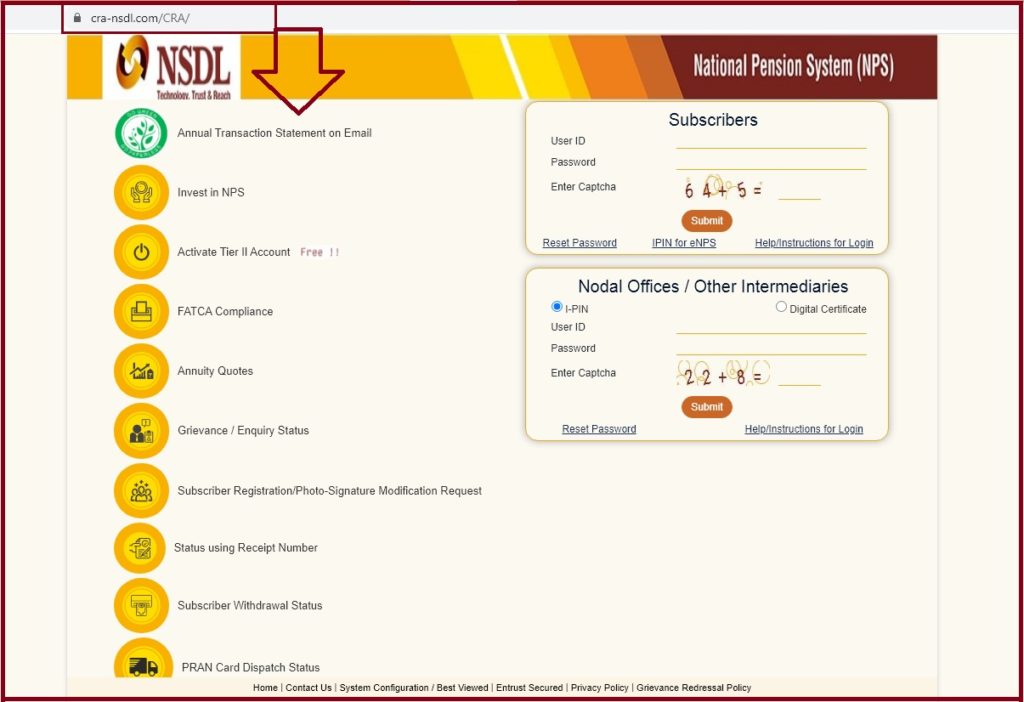

- Open the NSDL website portal through the link https://cra-nsdl.com/CRA/ to access FATCA online.

- On the menu, click the FATCA compliance tab to proceed.

- The self-declaration page will show, key in your PRAN number, and select submit button.

- Enter the mandatory details on the FATCA declaration form:

- Name

- Applicant’s PAN number

- Nationality

- Address

- City

- Country of birth

- Occupation income

- Tax residence number

- Recheck the information and select submit button.

- Click the check box for signing the declaration and authorization.

- The system will send an OTP to the registered mobile number.

- Enter the OTP to verify the process.

- Now the FATCA certification acknowledgment will show on the screen.

- Ensure to keep the acknowledgment number for reference.

Cra-nsdl.com

How to Fill FATCA Self-Certify form Manually

The NPS applicant can also enter the details manually in the following steps.

- On the self-declaration form, the user needs to enter the essential details such as Name, PAN card number, date of birth, and more.

- Enter your country details such as country of birth, citizenship—the residence of tax, whether you’re a US citizen or not.

- Indian citizens can proceed to the next step of signing the declaration. This proves that you agree with all details you entered.

- Self-certification, this part applies to people from other countries (not Indian). Suppose the tax identification number is not available. US residents also need to enter the details even without the TIN. The applicant must provide proof documents such as DL, PAN card, passport, UIDAI letter, and more.

Fatca Declaration Form

Download link

FAQ’s

Who is eligible to fill the self-certify FATCA form?

All NRI living in the US should fill the FATCA form through an online or offline process.

Why is it essential for one to submit the FATCA form?

All eligible applicants should fill the form to avoid freezing their accounts and investments. The process helps prevent evasion tax and keep proper data.

fatca full form?

Foreign Account Tax Compliance Act (FATCA)