Payment of GCC Property Tax Pay Online 2025-26. Chennai Corporation Property Tax Payment Procedure. Pay Chennai Property Tax using Paytm. Know how to pay GCC property tax 2025 online at https://chennaicorporation.gov.in/gcc/online-payment/property-tax/

Chennai Property Tax

Once upon a time, Greater Chennai Corporation is known as Corporation of Chennai or Corporation of Madras. GCC is the government body that administers all the developmental and infrastructural changes in the South Indian Metropolitan. Chennai is the Capital city of Tamilian South Indian state Tamilnadu. GCC is spread over 426km2 area and is the largest Municipal corporation in Tamil Nadu. All the people owing properties in Chennai should pay the property tax to Municipal Corporation of Greater Chennai.

GCC Property Tax

One can pay the GCC property tax is using different methods of payment. Greater Chennai Corporation allows its citizens to make the payments through Online, Offline and using Paytm App. The states and the corporations revenue highly depends on the property tax payments. So it is the responsibility of its citizens to pay the property tax on time to enjoy the developments in the state and in the corporation. Lets know the procedure of GCC Property Tax Payment.

Greater Chennai Property Tax Payment Online

The citizens can enjoy rush free and hassle-free payment of property tax just by sitting at their home. One can make the payment through the official tax payment portal maintained by the Greater Chennai Corporation and Tamilnadu government. Look at the detailed process of Tax payment GCC online.

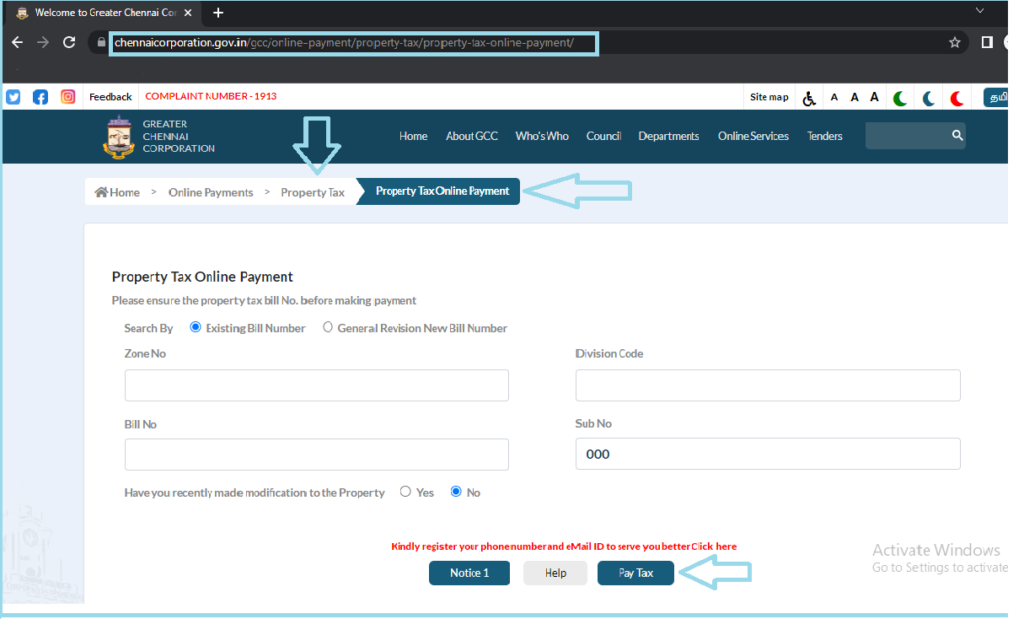

- https://chennaicorporation.gov.in/gcc/online-payment/property-tax/ is the official website link to pay Property Tax in GCC.

- Click on Property Tax Payment Option.

- Then click on Property Tax Online Payment option. Choose Existing bill number.

- Enter your property details like Zone Number, Division Code, Bill Number and Sub Number.

- If You have any modifications to your property recently ten click on Yes and enter the modified details.

- If no changes are made then click on No and click on Pay Tax option.

- You’ll see the amount payable on the next page.

- Choose the year to which you want to pay the tax.

- ten coose te mode of payment you like to prefer.

- Proceed for payment and download the payment receipt after successful payment.

Chennaicorporation.gov.in/gcc/online-payment/property-tax/

Chennai Property Tax Payment Offline Mode

To make the Property tax payment in offline method in GCC follow the below steps.

- Issue a demand draft or cheque on the name of “The Revenue Officer, Corporation of Chennai”.

- One can make the payment in any authorized banks, e-seva centers, Tamil Nadu Arasu Cable Television Corporation (TACTC) in Taluk Offices and to tax collectors.

- Visit any of the centers, and hand over the demand draft or cheque to them and provide them with the property details.

- After successful payment they will give you a payment receipt. Keep it securely.

Payment of GCC Tax through Paytm APP

In this digital era, one can make any type of work just on his fingertips. Likewise you can also pay the tax of your property in Chennai by simply using the Paytm Mobile Application or web browser. Here is the detailed guide to pay GCC Property Tax in Paytm.

- Open Paytm App in Your Android or Iphone.

- Go to Recharge & Bill Payments and click on View More.

- Then you’ll see Financial Services head and click on Municipal Tax option present under it.

- Search Greater Chennai Corporation in the search bar and click on GCC option.

- Enter your Property Id and click on Proceed.

- The amount that is to be paid in tax will be displayed and after verifying the details proceed for payment.

- Choose the mode of payment and the payment will take few seconds to complete.

- Save the transaction id and payment receipt.

How to Know Your Zone and Division Codes in Chennai

Zonal Codes in Chennai

One should know their property zone code and ward number to pay property tax in Chennai Corporation. So the GCC provided a feature to know the property zonal code and ward number just by simple clicks. The feature is available on the portal and one can use it easily.

- Go to the official property tax payment website of GCC.

- On the 1st page itself you can see Know Your Zone and Division option.

- Then point your property location on the Map given below.

- Now you can see the Zone number and Ward Number of Your Property location.

- Direct Link: https://chennaicorporation.gov.in/gcc/citizen-details/location-service/find_zone.jsp is the direct link to know the ward and zone numbers of your property in Chennai.

You can also know the Ward and Zone numbers from this table manually. The table gives the ward and zone numbers depending upon your property location.

The Chennai corporation zone Name & code, list Table is as follows:

| Zone of the Property | Name of the Zone | Ward Number |

| I | Thiruvotriyur | 1-14 |

| II | Manali | 15-21 |

| III | Madhavaram | 22-33 |

| IV | Tondiarpet | 34-48 |

| V | Royapuram | 49-63 |

| VI | Thiruvikanagar | 64-78 |

| VII | Ambattur | 79-93 |

| VIII | Anna Nagar | 94-108 |

| IX | Teynampet | 109-126 |

| X | Kodambakkam | 127-142 |

| XI | Valasaravakkam | 143-155 |

| XII | Alandur | 156-167 |

| XIII | Adyar | 170-182 |

| XIV | Perungudi | 168, 169, 183-191 |

| XV | Sholinganallur | 192-200 |

Get know how to pay Property tax in Mumbai/Bombay through this link https://www.npcindia.org/mcgm-property-tax-payment-online-2023-24/

How can I know the ward number and Zone number of my Property in Greater Chennai Corporation?

You can use the Mapping feature available on the portal or you can refer the above table to know your Ward and Zone Numbers.

Is there any rebate on advanced tax payments in GCC?

Yes, you can get 5% of rebate on the amount payable if you make the payment in the 1st 30days of new Financial Year i.e., till April 30th.

GCC Full Form?

Greater Chennai Corporation