Trivandrum Property Tax Payment Online procedure 2024-25. Kerala Property Tax Payment Online. Trivandrum corporation property tax online payment through Sanchaya Web Portal. Trivandrum land tax online.

Thiruvananthapuram

If you have a house, land or any other property in Trivandrum then you should make Trivandrum Property Tax Payment before December 31st 2023. Trivandrum has around 100wards under its boundaries and it has an area of 214km2. All the citizens who own properties within the TMC boundaries should pay property tax to Trivandrum Municipal Corporation. In this article you can get the detailed procedure of Trivandrum Property Tax Payment.

Trivandrum Municipal Corporation or Thiruvananthapuram Municipal Corporation

Thiruvananthapuram is the Capital city of Aesthetic beauty the Kerala State. Kerala is known for its natural beauty and is also called as the “God’s own Country”. Once upon a time Trivandrum is newly named as Thiruvananthapuram. The Thiruvananthapuram Municipal Corporation is the oldest and the largest Corporation in Kerala. It is the civic body that governs the Thiruvananthapuram city of Kerala. The funds collected in the form of property tax and other taxes from the citizens of TMC are used for developing the state and the corporation. These taxes are the primary source of revenue to the TMC. Read the description below to know all the different methods of property tax payment in Thiruvananthapuram.

Modes of Trivandrum Property Tax Payments

You can make the Trivandrum Property Tax Payment either by Online or Offline methods. In Online method you can make the payment using the official web portal. Online mode of payments offers you hassle-free experience in tax payment. You can use any mode of amount payment in Online Property tax Payment in TMC. Offline method of tax payment requires physical visit to any of the service providing centers. Lets learn the step by step procedure of each method of tax payment in Trivandrum.

Trivandrum Property Tax Payment Online

You can simple pay the property tax using your mobile or desktop with few details. It just takes less than 10minutes time and there no strain of standing in the queue or wasting your precious time. Follow the steps given below to pay TMC Property tax online through Sanchaya Web Portal.

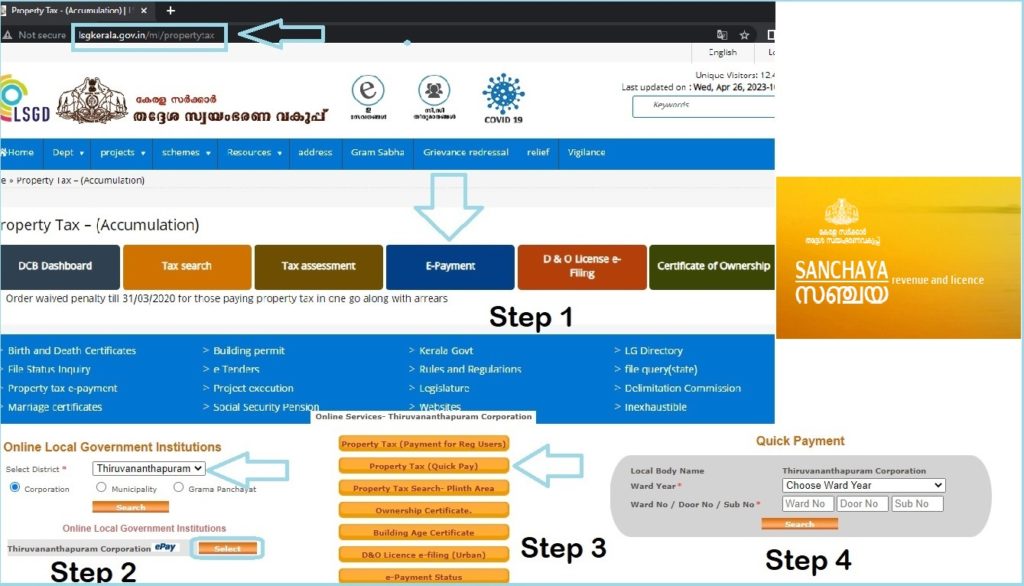

- visit http://lsgkerala.gov.in/ml/propertytax is the direct link to property tax in Thiruvananthapuram corporation.

- Open your web browser enter the given link.

- You’ll see the official tax payment portal of Trivandrum Municipal Corporation.

- The portal has a default language Malayalam change it to English for your convenience.

- In the available options Click on E-Payments option.

- Then select thiruvananthapuram corporation and proceed.

- If you are registered user, click on Property Tax(reg Users) and login with the cedentials and make the payment.

- If you are a new user, then click on Property Tax Quick Pay option.

- Enter your Ward number, Door number and Sub Division Number and click on search.

- After few seconds you can see your property details along with the Owner Name.

- If all the details are correct, check for the amount payable towards property tax.

- You can see the breakup and details of all the taxes.

- Enter your Email id and mobile number and enter the captcha.

- Click on Pay Now and choose the preferred mode of Payment.

- You can make the payment through Net Banking, Credit cards or Debit Cards or UPI.

- After successful payment you’ll receive a payment receipt, download it for future references.

lsgkerala.gov.in/ml/propertytax

SANCHAYA Web Portal

The Sanchaya Web Portal is the official website of Kerala State which facilitates the payment of various revenue payments. It is the Revenue and License Module for the official government institutions of the state. This module allows the users to login into their personal accounts and make hassle free payments by entering some basic details using QuickPay option. We can also view the building details,online statistics in this portal. https://sanchaya.lsgkerala.gov.in/ is te direct link to enter te sanchaya website. Once can also download the payment receipts and also check the payment status using this portal of Kerala State.

Offline Payment of TMC Property Tax

To pay the property tax in offline mode visit any authorized bank or Muncipal Corporation office and provide the service operator with your property details. He will tell you the amount you have to pay. Use the available mode of payment and complete the tax payment. Keep the payment receipt safely.

Factors Effecting Tax Rates in Trivandrum

The age of the buidling, type of construction, type of the building(residential or commercial),Occupancy type,area of construction,base value are all the factors that effect the taxation in Trivandrum. If there is any delay in tax payment you have to pay a late fee of upto 2% to 5% interest on the whole taxable amount.

To Know the procedure of Property tax payment in Tirupati, click on this https://www.npcindia.org/tirupati-property-tax-payment-online/

Can I check the payment Status in the portal?

Yes, you can check the Payment status in Sanchaya Web Portal.

What is the due date to pay property tax in Trivandrum?

The due date is extended till 31st Dec 2023, you can pay the property tax without any late fee before the deadline.

TMC Full Form?

Trivandrum muncipal corporation (TMC)